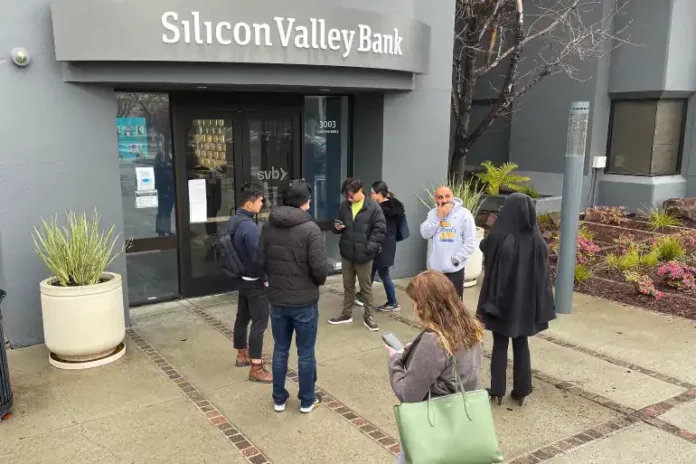

Two of the largest US regulatory agencies, the Federal Reserve and the Federal Deposit Insurance Corp, have issued reports indicating the need for tighter supervision of banks. The reports follow the collapse of two large US banks: Silicon Valley Bank (SVB) and Signature Bank. The reports stated that both banks failed due to mismanagement, a failure to address basic risks, and prioritizing growth over responsible banking. The Fed report, in particular, was scathing about its own supervisors’ failures to identify problems at SVB, while the FDIC report revealed a lack of sufficient staffing to do the work of supervising Signature Bank.

The reports highlighted several supervisory lapses and failed to lay responsibility for the bank failures at the feet of any specific senior leaders inside the agencies. The Fed report signaled a need for stricter regulation and supervision of banks with over $100bn in assets, and the regulator will re-examine how it supervises and regulates liquidity risk. The report also stated that tying executive compensation to management’s addressing of supervisory weaknesses could be a solution.

The regulator will also focus on improved speed, force, and agility of supervision and stronger standards applying to a broader set of firms. Increased capital and liquidity requirements could also have bolstered SVB’s resilience. The fallout from the failure of SVB threatened the ability of other banks to provide financial services and access to credit, thus highlighting weaknesses in supervision and regulation that need to be addressed.

The reports also revealed that both SVB and Signature had unaddressed citations on safety and soundness, with SVB having 31, triple the number of its peers in the banking sector. The FDIC report indicated that Signature Bank failed due to poor management and a pursuit of rapid, unrestrained growth with little regard for risk management. The reports have led to a reassessment of smaller banks’ impact on the broader financial system, highlighting the need for tighter supervision and regulation.